Get Involved Today!

Decide which plan works best for you

ABOUT

We give step-by-step tutorials

Stock, Options and Crypto trading can be very confusing, especially for those who are new to it.

This is why at Malibu Investing, we provide you with step-by-step tutorials on how to set up a broker account, read charts and predict plays, how to take profits and manage all of the risk you are taking on.

Server Benefits

Learn how to trade

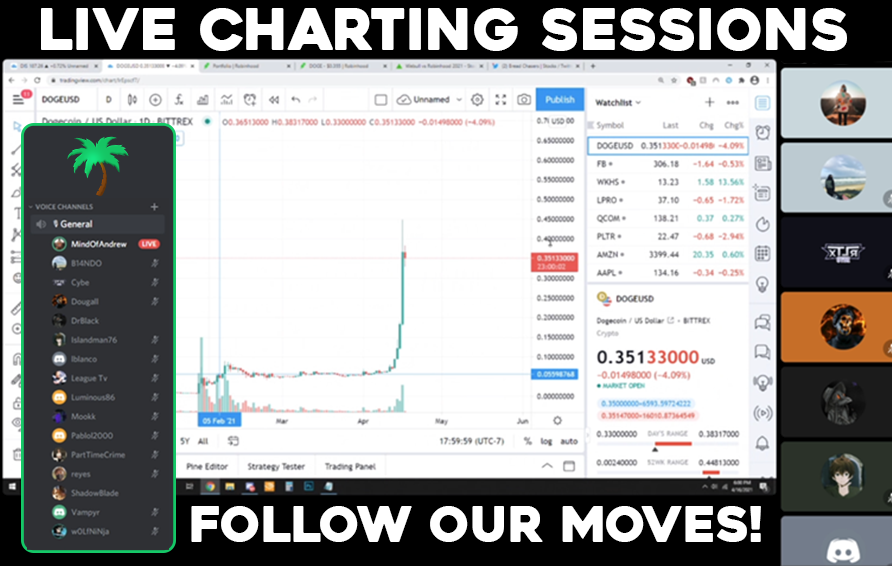

One on One & Group Trading sessions

We understand that trading can be confusing, especially for new learners. We are here to make the learning experience easier and help you learn how to manage risks properly.

We teach everything from trading and charting to risk management and taking profits.

A Open Platform for new and experienced traders.

Learn and earn in our group chat

As an established trader, it’s important that all news and updates are tracked with a stock. With so much going on, our server offers multiple sources of news and information tracked the minute it’s released by the administrators and signalers who are invested in them.

By becoming a part of Malibu Investing, you don’t have to always be present at your desk. Most of our members in fact use our services to alert them while they’re out enjoying their lives.

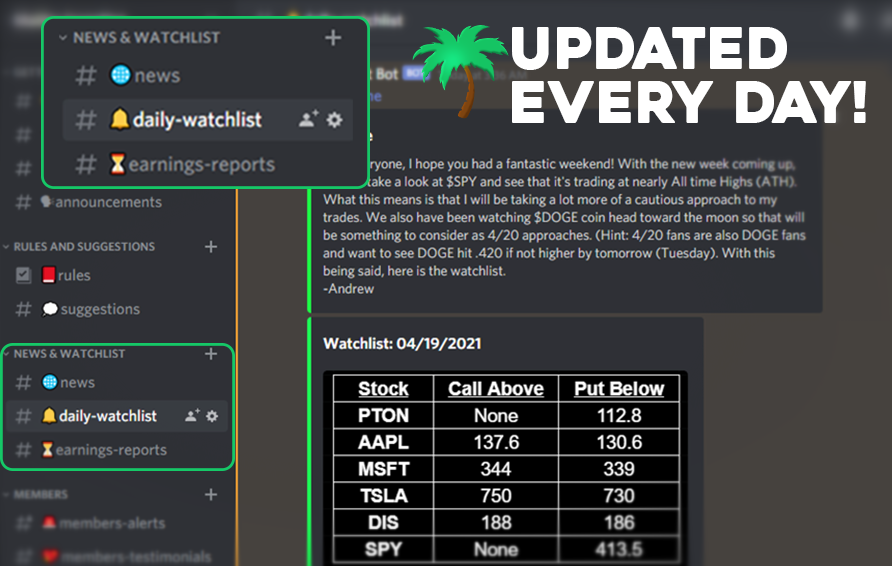

Before trading begins, we post our daily watchlist. This tells each of our members what plays we are looking at investing in for the following day. This also includes what price we will enter the play in and more!

Get started now

Beginner, intermediate, or expert, we are the group for you.

Select Membership

Choose which plan works best for you!

Submit payment

Once you pay, Include your Discord Username so we can send you an invite!

Join and Enjoy!

You will receive an invite and then you we be able to enjoy the trading rooms and signals

FAQ'S

Below we’ve provided a handful of commonly asked questions related to this topic!

Should I buy [insert stock/option here]

It is up to you whether or not you should or should not do something, we only tell you what we are doing and what we are seeing. We are not financial advisors.

Is it too late to enter [insert play here]?

If the current entry price of the play is more than 10% away from our entry, you are too late. Move on and be patient for another play. It is ultimately up to you to be proactive and get in plays as they are called out

Should I hold [insert play here]?

We alert when we exit our plays in the signal channels. If you are trading options and are down more than 15-20% on a contract that expires less than 2 weeks from now, cut your losses. Otherwise, evaluate your risk and make a decision on whether or not you should hold.

Any plays today? Any swings today? Anyone getting in any good day trades right now?

We make plays every day, our highest conviction plays go on our personal signal channels and we alert other plays in the members signals channel.

How much money should I put into [insert play here]?

Larger accounts should not be putting more than 1-5% of their total capital into any single trade. Smaller accounts should not be putting more than 10-15% of their total capital into any single trade. Under no circumstances should you be putting more than 50% of your portfolio into any trade, period. Always leave some cash in your account to use for later.

How do I interpret the info on the daily watchlist?

Our watchlists indicate key price levels that we are watching for potential plays. We believe that a move below/above these areas of value is significant and could indicate a trade opportunity.

Please note that all trades taken from the watchlist must be actively managed and we will NOT be signaling our exact entries or exits for watchlist plays and that the majority should be closed the same day they are open. Have some day trades, do some due diligence, and come in with a plan if you want to take watchlist trades. Watch for volume, confirmation, and a close above/below the given level (+ for above, - for below). Also, try not to enter too far from the given level, so if a stock opens far above the given watchlist level, don't take the trade.If you can't manage your own risk without following someone else, don't take these trades

What does it mean when you guys say you are "scaling" a play?

Scaling is when we take profit on a portion of our position, reducing our risk of holding. This is usually done at either an arbitrary percentage gain or a level of support/resistance. Scaling can also refer to building a position over time to manage risk

Is [insert stock here] gonna go up/down tomorrow?

We can only know when tomorrow comes

Why did my options decrease in value even though the underlying stock moved in the right direction? (Up for Calls, Down for Puts)

Multiple reasons for this. Theta (Time Decay) may have affected your contract value, especially if your expiration date is less than a month away or if your contract is too far OTM. Implied Volatility (IV) decreasing may also be a factor, especially if there was an important event relevant to the stock that happened recently. This is why buying naked options before an ER is usually a bad idea. Try to take note of these things before you buy contracts; buy when IV is low, and make sure your theta isn't enormous

[insert stock here] is running like crazy today! Should I get in? Seems too good to pass up...

If you're a fan of losing money, get in on the big green candles as its flying. If you're a fan of making money, wait for the pullback and actual evidence of continuation before playing a stock like that. Otherwise, better not the participate, especially if you are a less experienced trader. There is always another play

Is [insert stock here] a good play?

If we are talking about it, it definitely has potential, but you should always do your own Due Dilligence before hopping into a play. We are not stock pickers and you should not be stock picking.

Should I do [insert decision here]

We are not legally allowed to tell you what decisions to make when it comes to your financial portfolio. That being said, we are here to give you access to the moves our staff members make and inform you of some of the risks involved. Remember, trade at your own risk and do your own research!

What do you mean when you say you are long or short a stock

If I am long on a stock, I have taken a bullish position and I am betting that the price will rise. If I am short on a stock, the opposite is true: I am betting on the price falling and a have taken a bearish position. The terms “long” and “short” do NOT refer to the time frame of the trade or how far the expiration date of your contract is.

RESOURCES

BloomBerg Markets

TradingView

Coinbase

Contact Us

We are always willing to hear questions and feedback! Be sure to fill out the form below and our team will try to get back to you as quickly as possible. Thanks!

-

443 123 4567

-

MalibuStockInvesting@gmail.com

-

Message on Discord